Financial Strategies

Our Services for Individuals and Families Include:

Strategies for Individuals and Families

Don't let fear of the unknown keep you from pursuing your financial future. Farah Financial Group is your one-stop financial partner — the one you can turn to whenever a financial or related need arises. We have an established alliance of professionals that can fulfill your needs.

Our in-person consultation allows us to get to know your dreams and goals and allows us to suggest financial strategies specifically designed to address your needs.

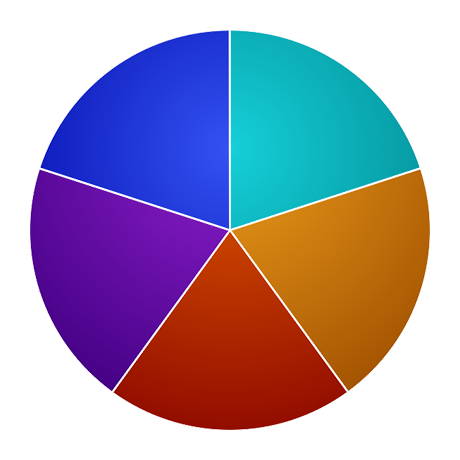

Explore each of our services in the chart and see how our team can become your resource for the crossroads in life.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. LPL Financial and Farah Financial Group do not provide tax advice or services.

LPL Financial and Farah Financial Group do not provide tax advice or services.

Customized Retirement Programs

Our main objective is to give you, the individual, investment growth, control and maximum tax advantages. Farah Financial Group’s team will gather vital information and then personally design and tailor strategies with your retirement goals in mind.

We also provide programs that are guaranteed and outpace inflation with tax-deferred growth.

Based on new health regulations, we have a specialized team to assist in this important area.

Tax Planning

Farah Financial Group specializes in one of the industry’s best kept secrets: self-funded pension plans. These allow you to be your own bank, providing exceptional flexibility, control and tax advantages. Maximum funding permanent life insurance and Roth IRAs are two jewels of the industry.

Creative Education Funding

College costs are rising faster than the rate of inflation, so getting an early start to maximize time and tax deferral is vital. College 529 plans are very popular and allow for significantly larger deposits than an educational IRA. Prepaid college plans are a good option that provides a hedge against inflation on future college costs. Based on the student’s age, there are additional options which may further maximize tax advantages and allowable deposits.

401(k)/QRP Management

We can help you understand the benefits and detriments of the options available for idle 401k or other retirement accounts from a prior employer.

Estate & Legacy Planning

Peace of mind is priceless in regards to legacy planning. Determining whether a trust or will is suitable would be the 1st step.

Options we specialize in for accomplishing these goals are:

- Stretch IRAs

- Irrevocable Life Insurance Trusts (ILITs)

- Custodial Accounts

- Survivorship Trusts

- Special Needs Trusts

- Living Trusts

Contact us today and let us create a customized retirement program for you.